As one of the first countries in the world to establish a modern social security welfare system, Australia has attracted countless people from all over the world to immigrate to Australia with its comprehensive and extensive welfare policies. Statistics show that the Australian government spends at least 42 billion Australian dollars in pension benefits every year, which is obviously a huge number in a country of only 25.44 million people.

In response to the Final Report of the Royal Commission into Aged Care Quality and Safety (Royal Commission), the Australian Government has implemented a $17.7 billion aged care reform plan. This initiative will implement epoch-making aged care reforms and provide aged care services full of respect, care and dignity for older Australians.

When you get PR (permanent resident) status through parental immigration, you can start to enjoy the benefits provided by the Australian government. The benefits that can usually be enjoyed include the following five categories:

1. Medicare

As long as you enter Australia as an Australian permanent resident, you can apply for a Medicare card on the first day. With a Medicare card, you can enjoy all public medical services in Australia. Help cover the cost of a range of medical services. The benefits provided by the Medicare card mainly include three categories:

- Free or reduced rates for treatment by doctors, specialists, optometrists, and in certain cases by dentists and health practitioners. If a clinic indicates that it is bulk billing (Bulk Billing), then the Medicare card can be used to avoid outpatient bills.

- Use a Medicare card to enjoy some discounts on prescription drugs; use a Medicare card to see a doctor in a public hospital, and if you meet the discount conditions, you can receive free treatment and hospitalization, and you only need to sign the bill without paying.

- Even if a patient who purchases private insurance sees a doctor in a private hospital, the Medicare card can reimburse 75% of the outpatient and handling fees. However, hospitalization fees, surgical fees, and medical fees in private hospitals are not covered by Medicare’s reimbursement, and must be reimbursed by private insurance.

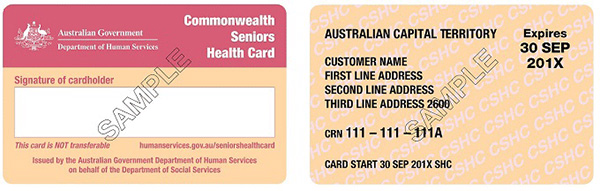

2. Commonwealth Seniors Health Card (CSHC)

After parents get PR, as long as they reach the age of 60, they can apply for a senior card. The application process will not assess residence time, personal income, etc. The old age card mainly provides some social benefits for the elderly. For example, public transportation, shopping, etc. can enjoy discounts.

3. Seniors Card

The health card is also a low-income card, and you must meet certain income conditions before you can apply. The function is similar to the senior card. However, the application range will be wider, and it can be used for discounts on water, electricity, gas and other bills, and municipal fees can be reduced or exempted.

4. Federal Senior Health Card Aged Pension

As long as the parents are at the age of the Aged Pension (Aged Pension) and have lived in Australia for 104 weeks, they can immediately enjoy the Elderly Health Card. Although you need to live in Australia for 104 weeks when you apply for the card, you can apply in advance 3 months before your birthday when you reach the age requirement for the Aged Pension. From 1 July 2017, the age requirement for old age pensions for Australian parents to migrate will be 65 years and 6 months. After that, the old age pension will increase by 6 months every 2 years until 1 July 2023.

5. Pension Superannuation

Employer-paid superannuation (Superannuation) Australian superannuation Superannuation is a superannuation paid by the employer for employees over the age of 18 and with a monthly pre-tax income of not less than 450 Australian dollars. This pension is called (Super Guarantee Charge), and employers must pay no less than 9.5% of the employee’s annual salary before tax. In addition, the law also stipulates that the pension must be withdrawn in batches or all at once after the individual reaches the legal retirement age, or other hard indicators such as disability, financial crisis, departure, settlement, etc. According to the residence requirements in the “Old Age Pension” of the Joint Signatory Center, the applicant must have lived in Australia for 10 consecutive years, or the combined period of residence exceeds 10 years, and one of the residence periods is 5 years of continuous residence. The amount of old age pension is related to the applicant’s “income” and “assets”.

Epilogue

Australia’s social security system is obviously very mature and complete, covering a person’s life trajectory such as “medical – birth – education – employment – housing – pension”. For many people who come to Australia to study, work and reunite with their families, becoming an Australian PR is a follow-up and a guarantee for the quality of life in Australia.