Source : abc.net.au

![]()

Summary:

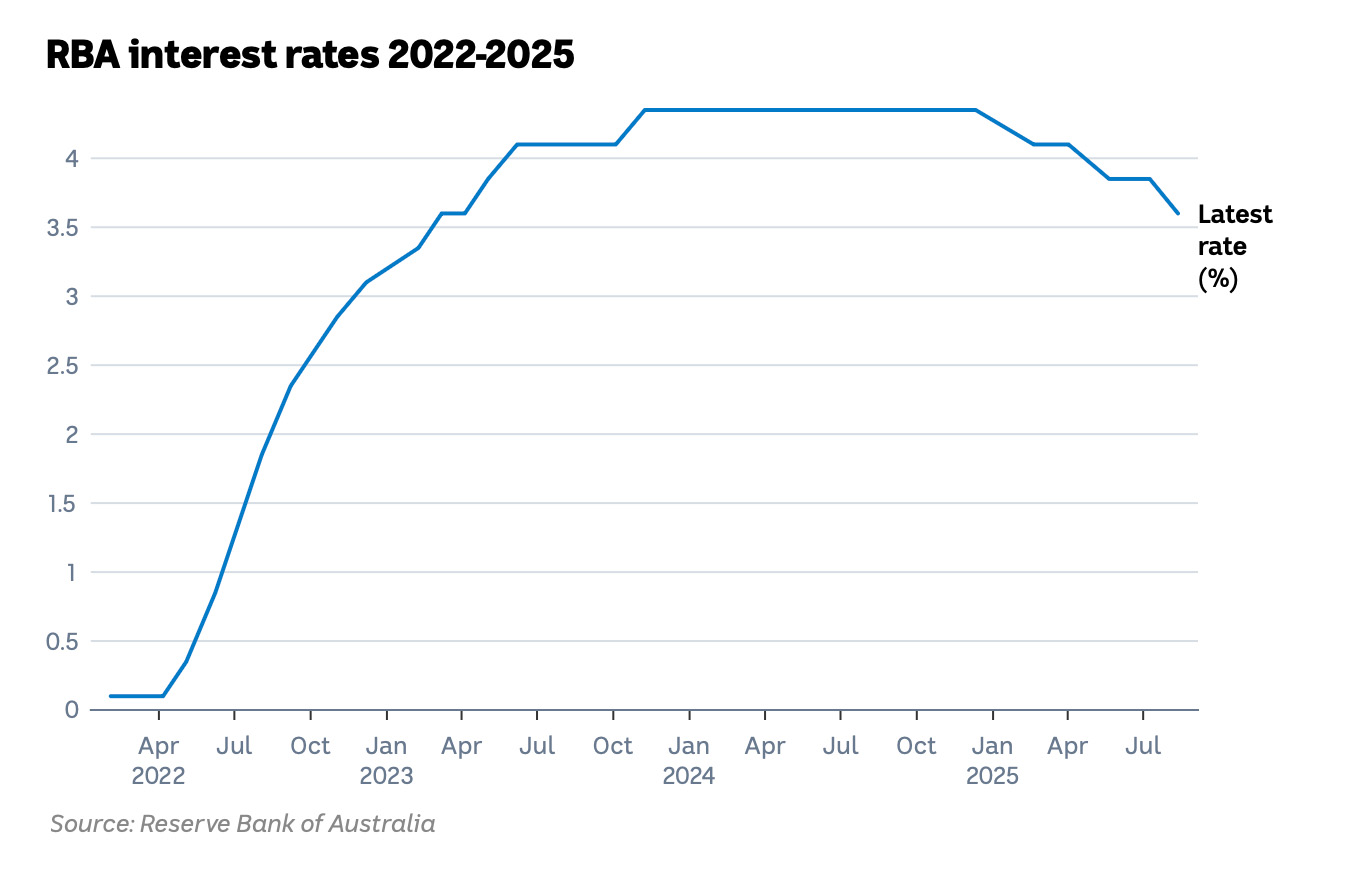

The Reserve Bank of Australia (RBA) has lowered the cash rate by 0.25 percentage points in August, bringing it down to 3.6%. This marks the third rate cut in 2025 and comes after July’s unexpected “on hold” decision.

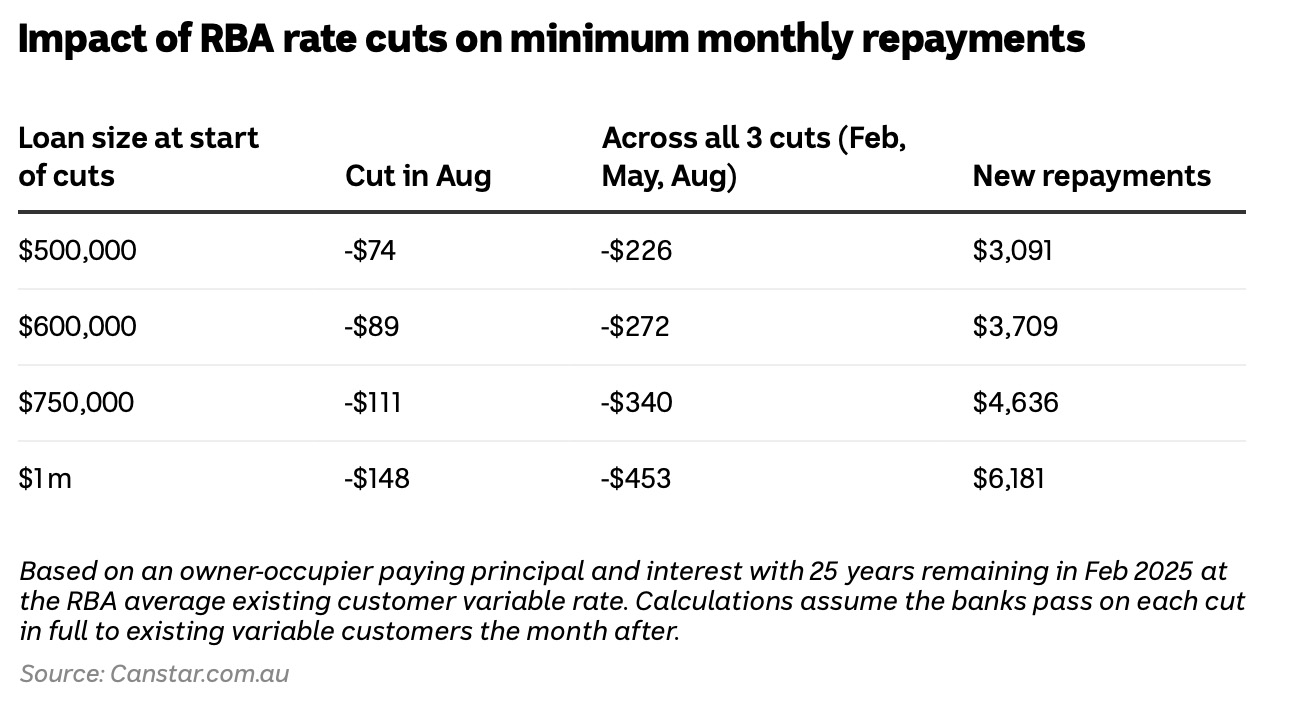

For an owner-occupier with a $750,000 mortgage taken out in February, the latest cut could reduce minimum monthly repayments by around $111 — provided their lender passes on the full cut. That brings total savings from this year’s three cuts to approximately $340, according to Canstar.

What’s next?

The RBA’s next interest rate decision will be announced on 30 September, followed by two more meetings in Novemberand December.

Why the cut?

The August decision was unanimous, a contrast to last month’s divided board. Easing inflation and a slight softening in labour market conditions led the RBA to conclude that “further easing of monetary policy was appropriate.” Since the start of 2025, the cash rate has fallen by 75 basis points, taking it to its lowest point since April 2023.

Following the announcement, the Australian dollar dipped below 65 US cents as RBA Governor Michele Bullock addressed the media. She signalled that further cuts are possible if economic conditions warrant them, stating, “The board will continue to focus on the data to guide its policy response.”

When asked about the “neutral” cash rate — the level at which rates neither stimulate nor slow the economy — Ms Bullock declined to give a precise figure, offering a broad range of 1% to 4%, and noted that neutral rates apply when there are no significant economic shocks.

How much will home loan repayments fall?

Several major lenders — including Macquarie, Commonwealth Bank, Westpac, ANZ, NAB, and AMP — quickly confirmed they would pass the August cut on to home loan customers.

According to Canstar, monthly savings from the latest reduction could be:

$74 on a $500,000 mortgage

$111 on a $750,000 mortgage

$148 on a $1 million mortgage

These figures are based on an owner-occupier repaying principal and interest over 25 years, with the average variable rate falling from 5.79% to 5.54% after the August cut. The calculations assume lenders pass on the reduction in full to existing variable-rate customers in the following month.

Borrowers are not obliged to lower their repayments, and most do not. In fact, Commonwealth Bank data from May shows that only one in ten eligible customers reduced their direct debits after that month’s rate cut. Those who maintain higher repayments will pay down the principal faster and reduce total interest paid over the life of the loan.