Bigger Caps. More Choice. A Fairer Start

From 1 October 2025, the expanded Home Guarantee Scheme will make it easier for Australians to step onto the property ladder. Income and location limits will be removed, while property price caps are lifted across most regions — giving first-home buyers the chance to purchase with just a 5% deposit and no lenders mortgage insurance (LMI).

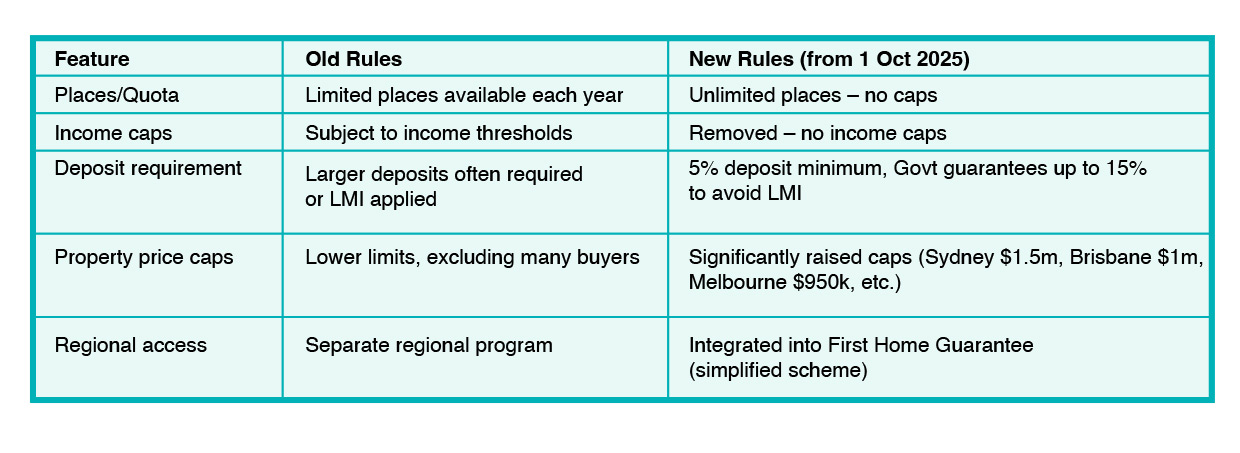

Key Policy Changes (Effective Oct 1, 2025)

Income and place limits removed

Property price caps lifted across most regions

Eligible buyers can still purchase with a 5% deposit, without LMI

What’s Changed?

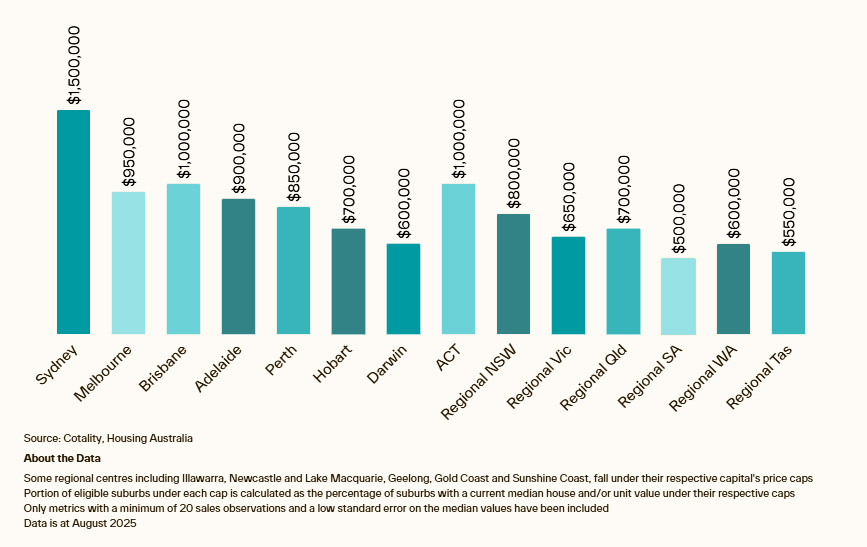

National reach expanded: Around 63% of markets now fall under the new price caps, up from just one-third.

Major city increases: Sydney’s cap rises to $1.5m, Southeast Queensland to $1m, and Adelaide to $900k.

Units in reach: A staggering 93.7% of unit markets now qualify, along with 51.6% of house markets.

These changes dramatically increase the number of suburbs now within reach — including many popular areas that were previously unaffordable.

Why It Matters for Buyers

More choice: No longer limited to outer suburbs or regional areas, first-home buyers can now explore established city and inner-ring markets.

Improved affordability: Recent Reserve Bank rate cuts (cash rate now at 3.6%) are reducing borrowing costs.

Rising confidence: Surveys show 57% of renters plan to buy within two years, a sharp rise from 42% last year.

As economist Kaytlin Ezzy explains:

“Previously, first-home buyers were largely restricted to more affordable housing options. The new caps create far greater freedom of choice.”

Why It Matters for Sellers & Investors

Stronger demand: A surge of first-home buyers will lift competition across entry-level and mid-tier markets.

Market momentum: National property values rose 1.8% in the three months to August, with annual growth at 4.1%.

Spring boost: Listings are up 9.4%, sales volumes have climbed, and sentiment is strengthening — creating an ideal backdrop for selling.

This policy isn’t just about helping buyers. It also signals to sellers and investors that the market is entering a period of renewed growth and activity.

The Bigger Picture

Australia’s housing market value: Now at $11.7 trillion.

Capital city growth: Brisbane, Perth, and Darwin are leading the way, with Darwin recording 10.2% annual growth.

Rental trends: Capital city rents up 3.4%, regional rents up 5.8% over the past year.

While challenges remain — especially saving for deposits and mortgage serviceability — the combination of government support, lower rates, and stronger buyer sentiment is reshaping the market.

Key Takeaway

For first-home buyers, the expanded Home Guarantee Scheme creates a fairer starting point and greater choice.

For sellers and investors, it signals fresh demand, rising competition, and a strong spring selling season ahead.

Now is the time to re-think your property goals — whether it’s buying your first home, upgrading, or selling into a confident market.