Australia could be on the verge of a major property market upswing in 2025, provided a critical event unfolds early in the year, according to a new report.

SQM Research’s Christopher’s Housing Boom and Bust Report 2025 forecasts the year’s property market trends, considering various economic scenarios.

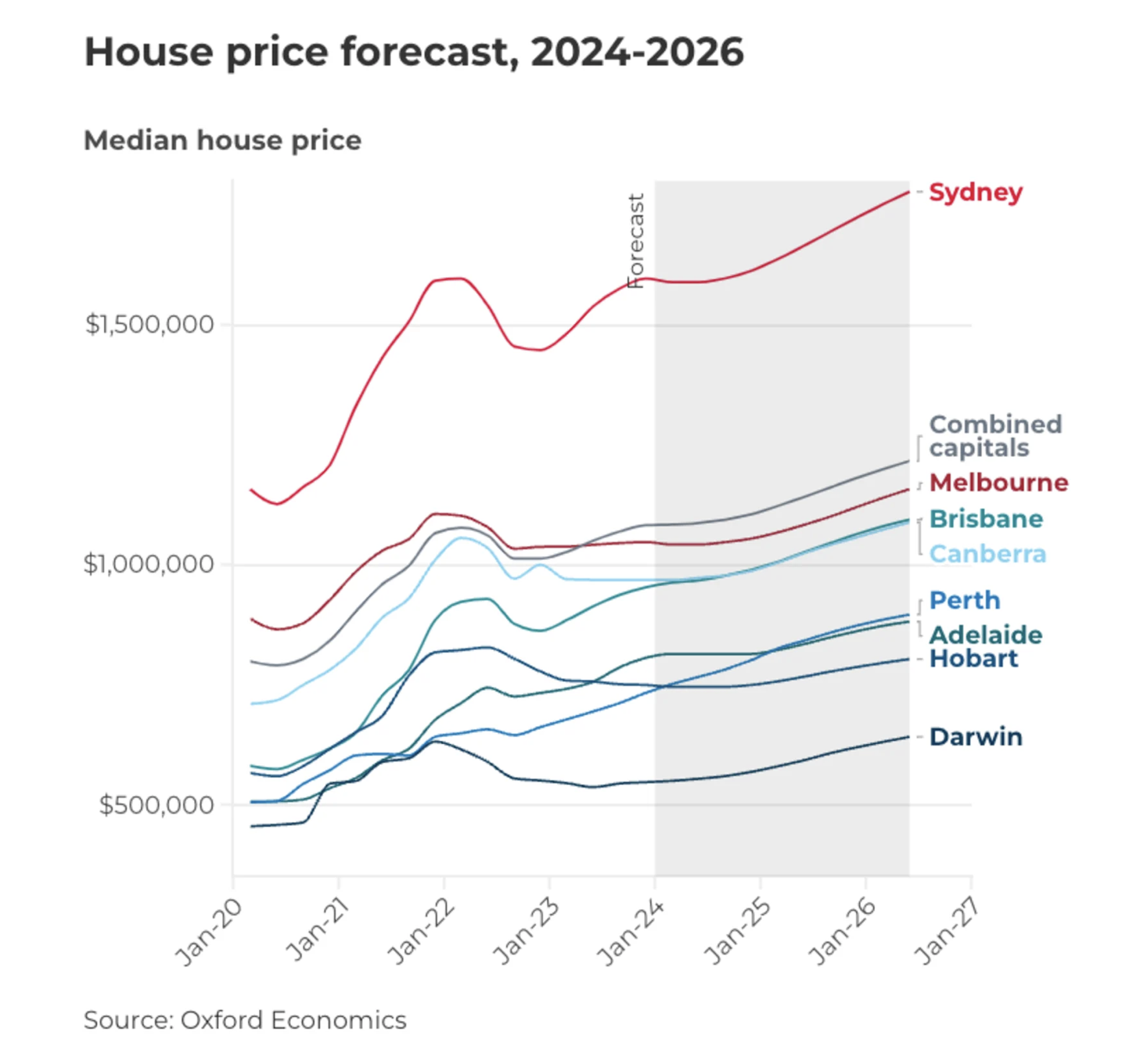

Under the most likely “base case” scenario — which assumes a 25-50 basis point interest rate cut mid-2025 and population growth exceeding 500,000 — property values are predicted to increase by 1-4%, as long as no new inflationary shocks occur.

Perth is expected to lead the market with growth of 14-19%, followed by Brisbane (9-14%) and Adelaide (8-13%).

Early Rate Cuts Could Ignite a Property Boom

If the Reserve Bank of Australia (RBA) cuts rates as early as February, national property values could see a surge of up to 10%. In this case, every capital city is projected to return to growth, with Perth topping the list at 15-20%, Brisbane at 11-15%, and Adelaide at 10-14%.

“Once rate cuts are implemented, we anticipate a swift rebound in demand, particularly in Sydney and Melbourne, where both cities continue to face housing shortages alongside strong population growth,” said the report’s author, Louis Christopher.

This scenario presents an opportunity for buyers to act now, gaining equity in these markets if rates decline in 2025.

Perth is forecast to maintain strong growth between 7-11%, provided commodity prices remain stable. “Sustained population growth, robust employment, and an undersupply of homes for sale will continue driving up Perth dwelling prices,” the report noted. However, a sharp drop in iron ore prices could pose a risk.

Alternative Scenarios

A fourth scenario, where rates remain unchanged but population growth exceeds 500,000, predicts a relatively stagnant market, with changes ranging from a 1% rise to a 3% decline.

PropTrack economist Eleanor Creagh emphasized that while interest rates significantly influence property values, other factors such as housing supply, construction activity, labor market conditions, immigration rates, rental market dynamics, and regional migration also play critical roles.

“Prices are expected to keep rising in the near term, and when interest rates start to decline next year, buying activity is likely to pick up, with price growth accelerating,” Creagh said.

Lower interest rates reduce borrowing costs, making mortgage repayments more affordable. They also enable buyers to qualify for larger loans, increasing their purchasing power. “This enhanced affordability is likely to boost buyer activity and confidence, further fueling demand in the housing market,” she added.