Source : @2025 RP Data Pty Ltd t/ as Cotality. Proprietary.

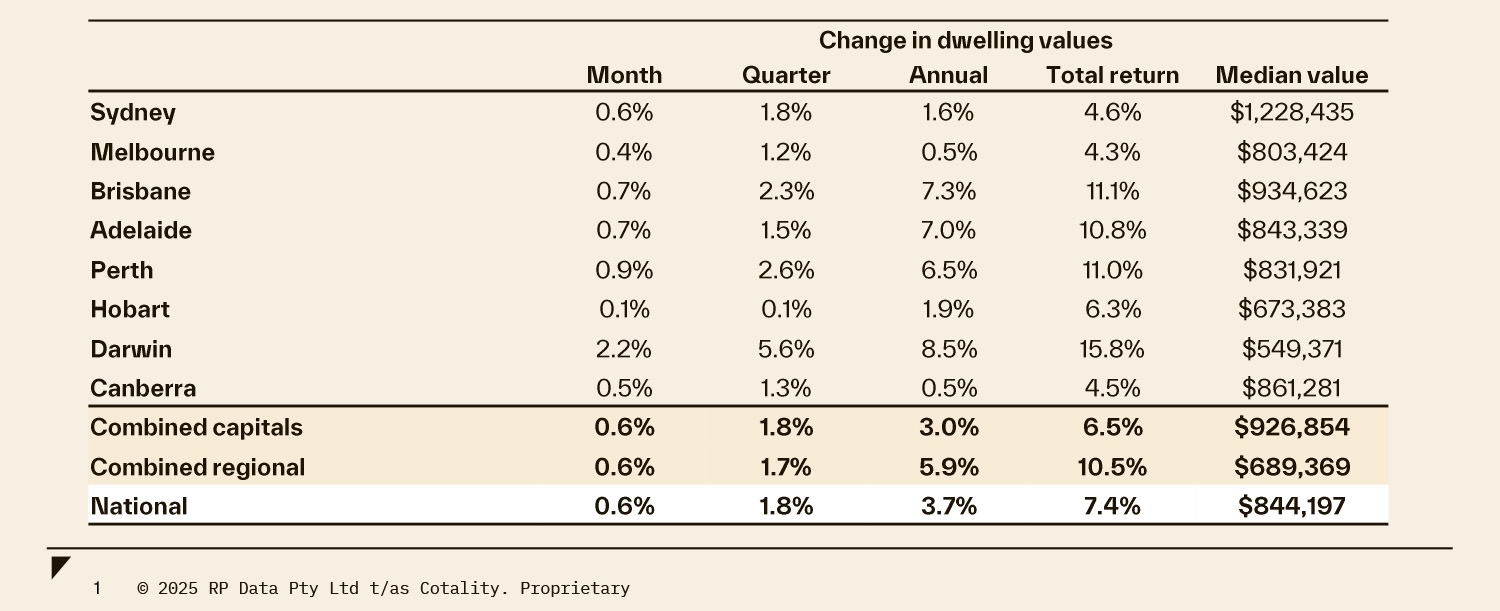

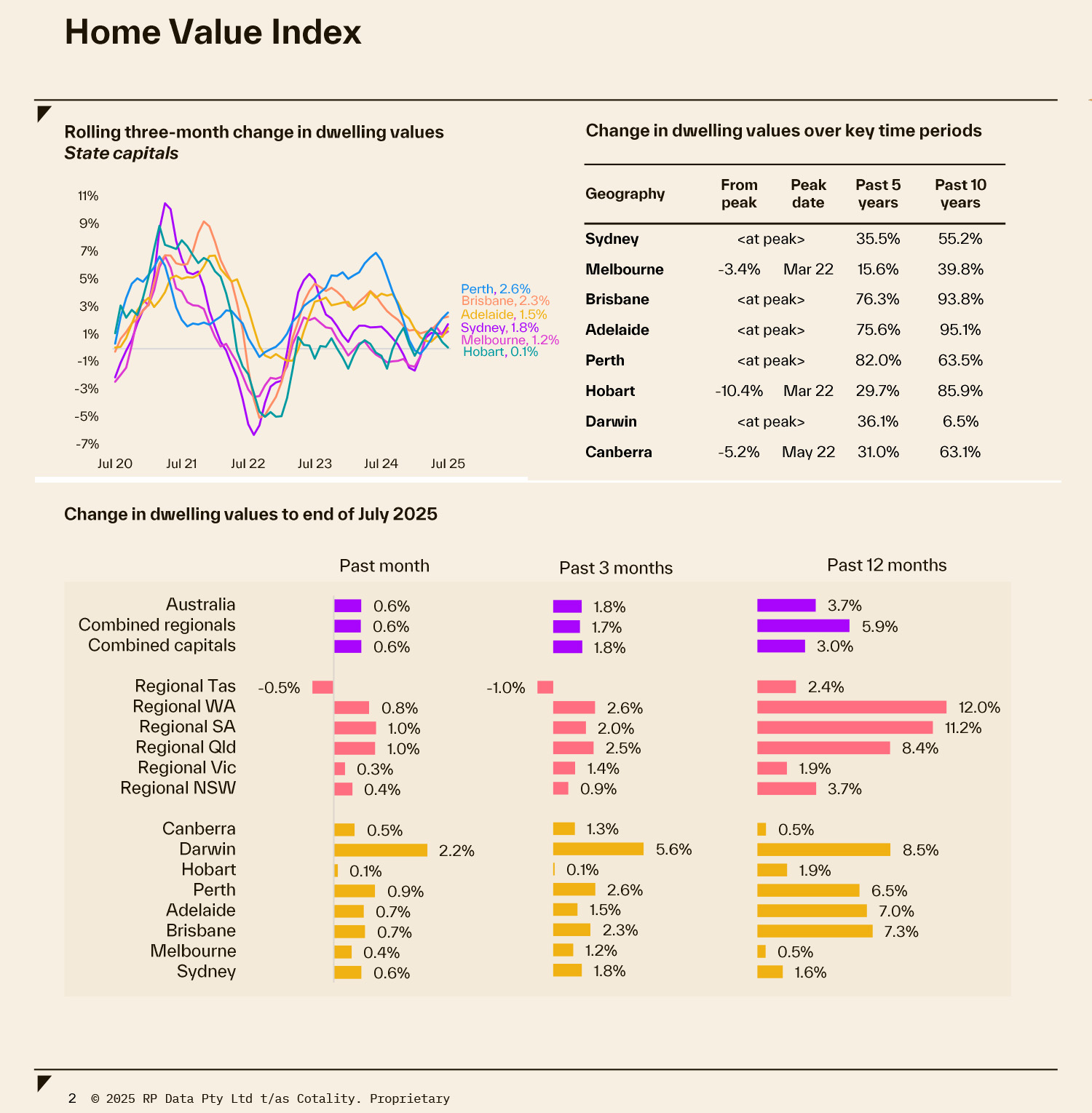

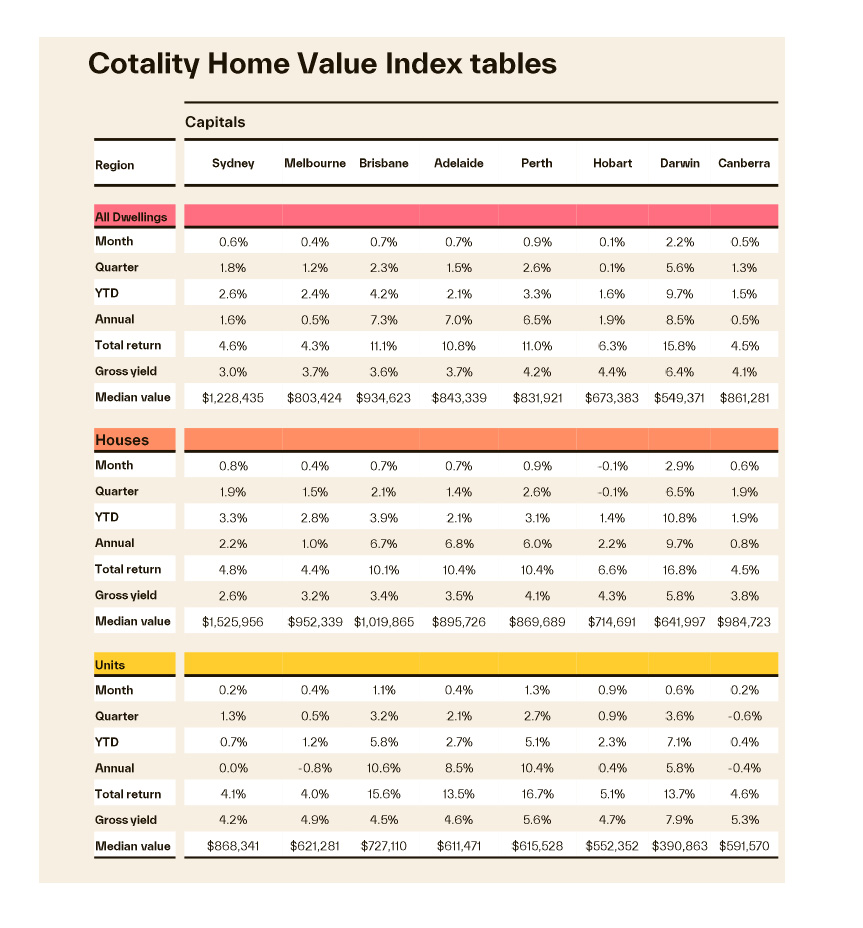

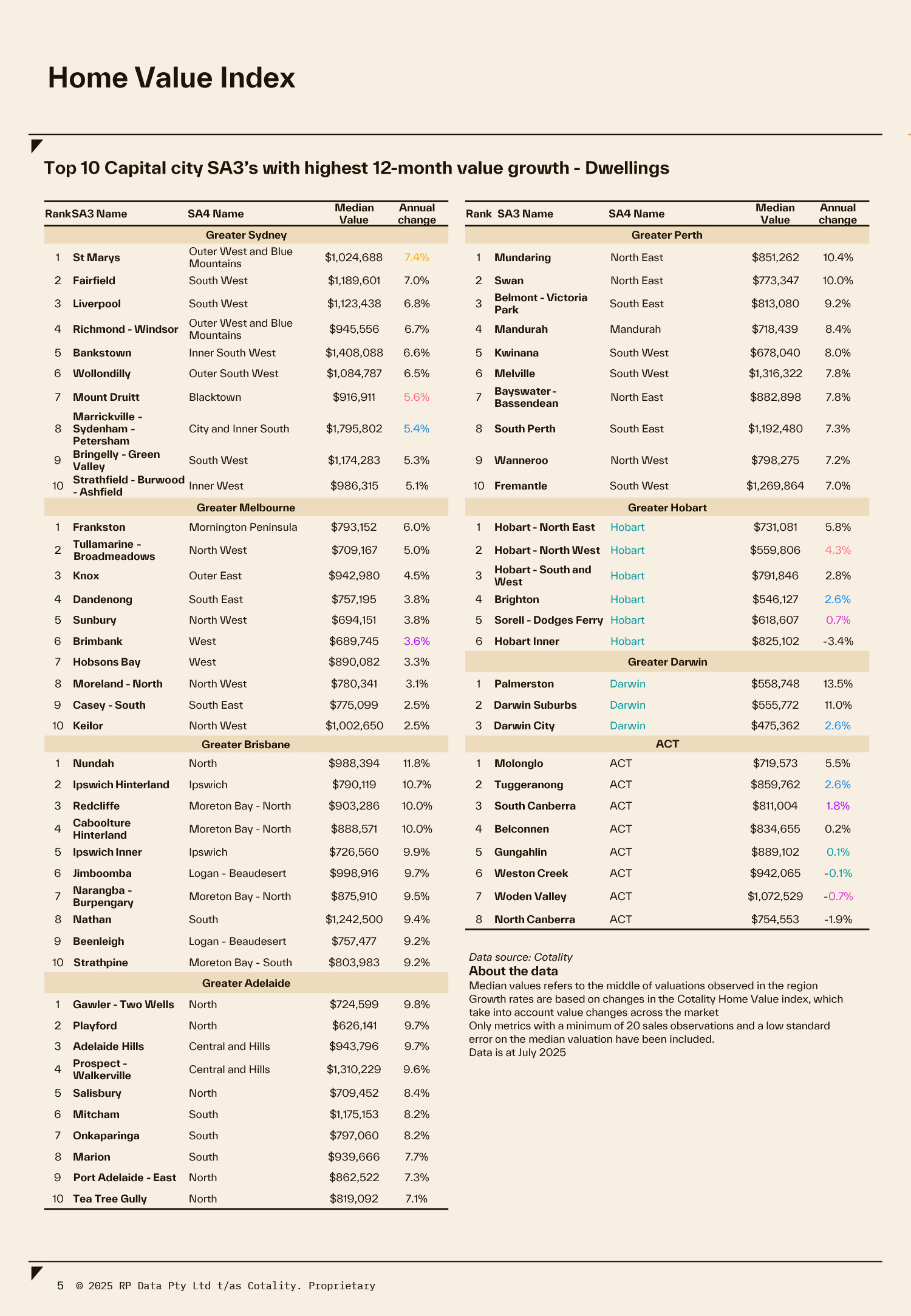

Australia’s property market continued its steady upswing in July, with national dwelling values rising by 0.6%—the sixth consecutive month of growth. All capital cities recorded value increases, led by Darwin (2.2%), Perth (0.9%), and Brisbane (0.7%). Although the pace has eased slightly since May, strong buyer demand, persistently low housing supply, and improved confidence are supporting stable price gains. House values are rising faster than units, driven by borrowing capacity and buyer preferences, while the gap between median house and unit values has widened to a record $223,000. Combined capital cities (1.8%) are again outperforming regional markets (1.7%) in quarterly growth, marking a shift after regional dominance earlier in the year.

Home Value Index – Rental Market Snapshot

Australia’s rental market is showing renewed signs of growth, supported by historically low vacancy rates and strong housing demand. While rental pressures had eased slightly earlier in the year, recent data confirms a rebound—particularly in unit rents, which are now rising faster than houses in many markets.

- Rents are rising again across Australia, driven by tight vacancy rates (1.7%) and strong demand.

- Unit rents are up 1.3% over the past three months, while house rents rose 1.1%.

- Darwin (units up 2.9%) led the growth, followed by Perth, Hobart, and Adelaide.

- Melbourne recorded the softest rental growth, with near-flat results.

- Annual rental growth is now positive again: houses +3.8%, units +3.2%.

Rental Yields

Despite rising rents, gross rental yields have slightly softened overall. However, investor returns remain stronger in regional areas and more affordable capital city markets. Darwin, for example, continues to offer the highest city yield, reflecting the appeal of low entry prices and solid rental income.

- National gross rental yield is 3.7%, down slightly from April.

- Darwin tops the capitals with 6.4%, offering the best yield.

- Regional markets outperform:

- Regional NT: 7.6%

- Regional WA: 5.9%

- Regional SA & Tas: 4.6%

- Combined regionals: 4.4% vs. capitals: 3.5%

- Other high-performing regional states include Qld and Vic (4.3–4.4%).

Disclaimer :All statements or claims related to this property have been made to the best knowledge of the vendors and agents, but no guarantee is made as to their accuracy. Any statements or claims should not be treated as facts, and instead should be verified by interested parties via in-person.