New data reveals that home prices across the country reached record highs in October, with most capital cities seeing monthly price growth. One previously slow-growing city, Melbourne, is leading the resurgence.

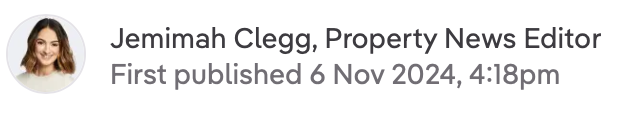

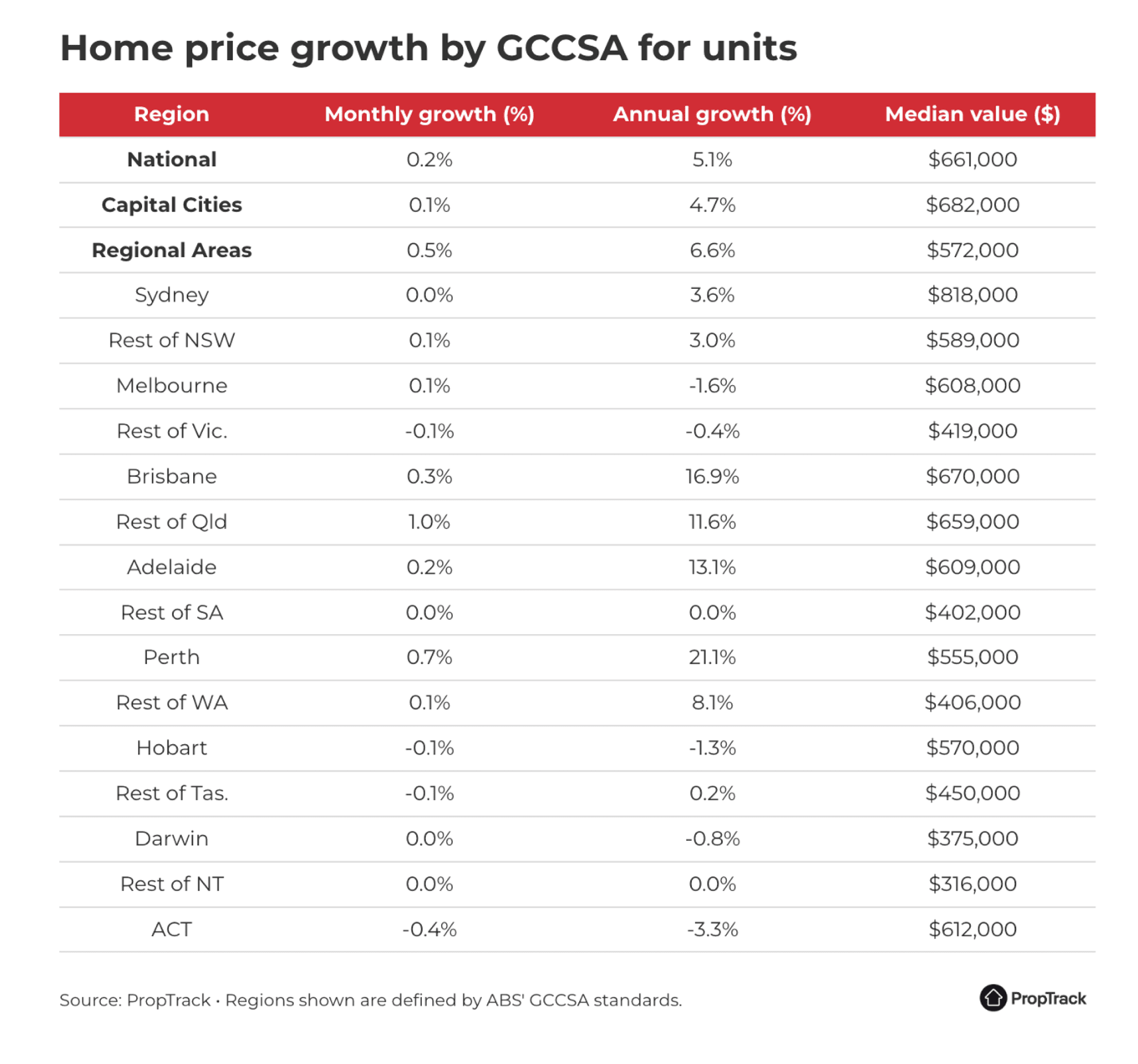

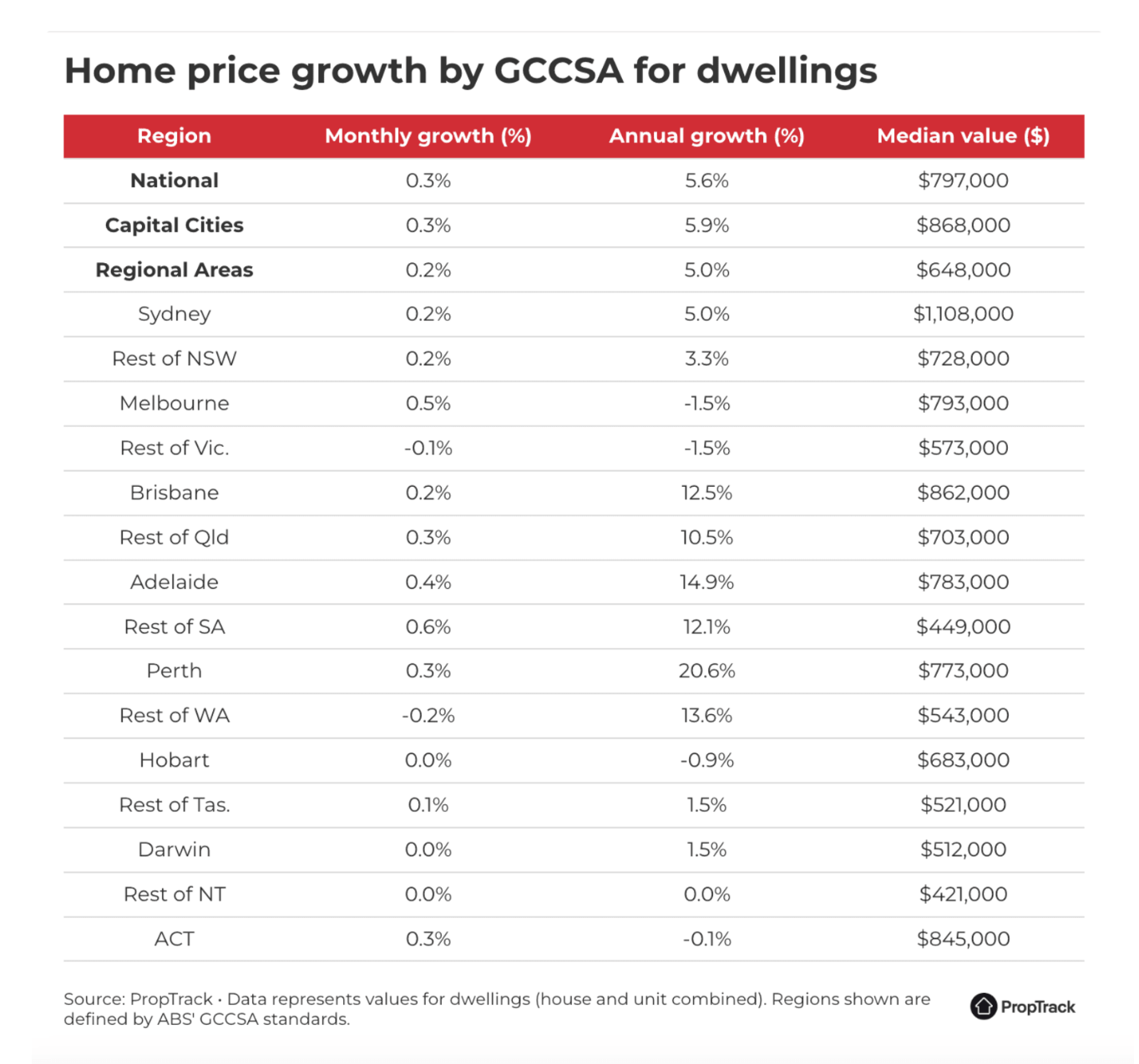

The PropTrack Home Price Index shows Melbourne posted the strongest monthly increase among capital cities, with a 0.5% rise in median dwelling price, now sitting at $793,000. Adelaide followed closely with a 0.4% gain, reaching $783,000, while Perth saw a moderate increase of 0.3% to a median of $773,000. The ACT’s median also rose by 0.3%, while Sydney and Brisbane recorded smaller gains of 0.2%. In contrast, Hobart and Darwin prices remained stable.

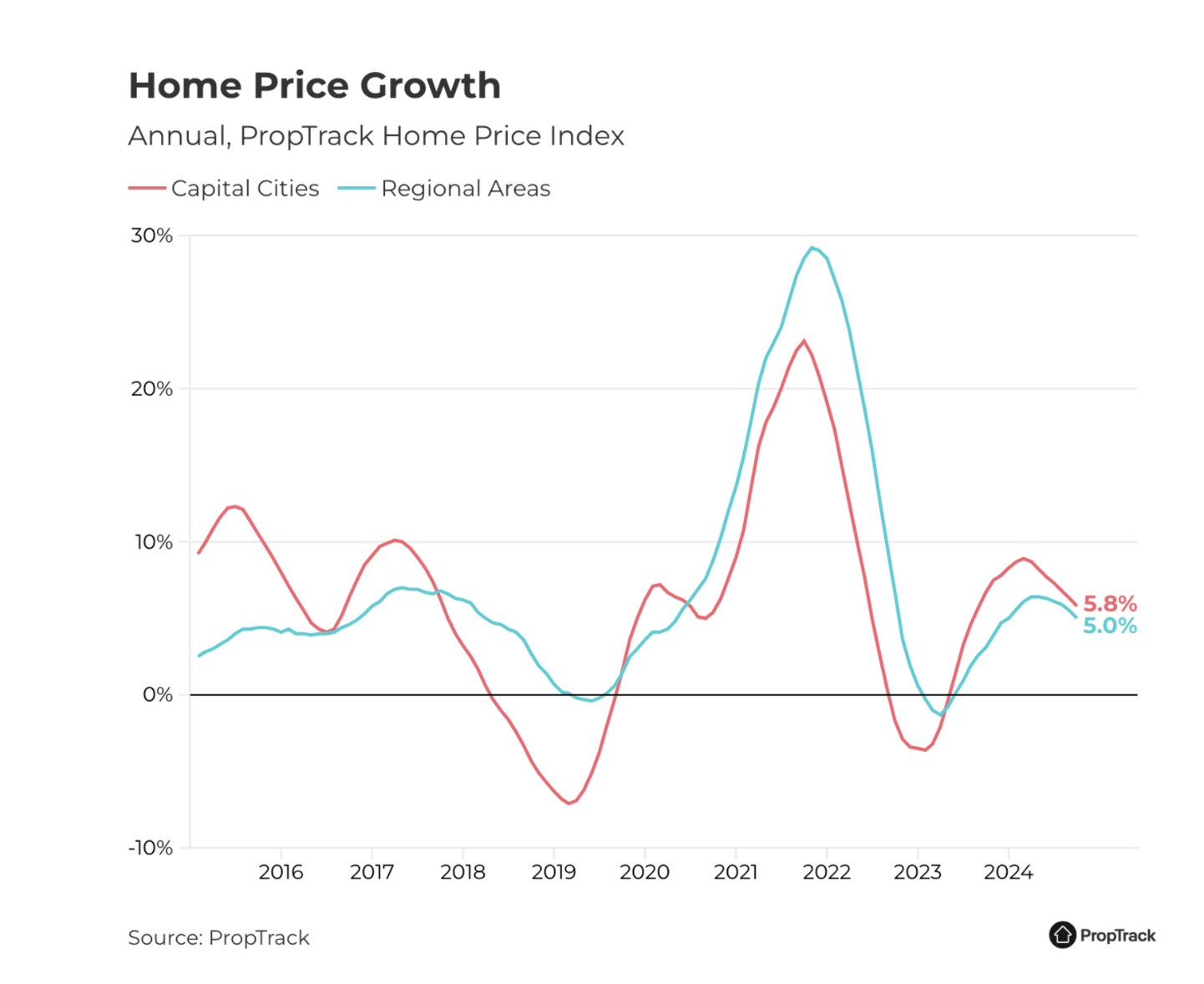

Nationwide, the median home price hit a record $797,000, with a 0.3% growth in October and a 5.6% increase over the past year. Notably, this is the first price rise in six months for Melbourne, which had experienced slower growth compared to other cities. According to Eleanor Creagh, senior economist at REA Group, Melbourne’s relative affordability next to Sydney, Brisbane, and Canberra may be attracting more buyers, especially as interest rate cuts are anticipated.

“Buyers might be looking ahead to potential rate cuts next year, although uncertainty remains around the timing,” said Ms. Creagh.

Regional Queensland saw a 0.3% rise to $703,000, maintaining its rank as the second-most expensive regional market after New South Wales, which grew by 0.2% to a median of $728,000. Townsville and nearby areas led regional Queensland with an impressive 0.85% increase for the month. Overall, regional areas saw lower growth than the combined capitals (0.2% versus 0.3%), reflecting varying supply-demand dynamics across regions.

Melbourne-based agent Halli Moore noted increased buyer activity this spring, although he was surprised by the price uptick. “There’s been a noticeable rise in sales volume, and quality properties are moving quickly,” Moore observed. In the city’s inner-north, Jellis Craig Northcote partner Nigel Harry reported that homes are selling prior to auction, with auctions being scheduled sooner, particularly in the $1 million range.

“There’s a renewed sense of confidence,” Harry said. “While it’s hard to pinpoint the market bottom, it feels like we might be there.”

Despite Melbourne’s positive growth, Ms. Creagh cautioned against assuming this marks a long-term trend. “One month’s growth is promising, but only time will tell if October is truly a turning point for Melbourne as buyers take advantage of its relative value,” she added.