![]()

A major shift is underway in Australia’s property market after the Reserve Bank of Australia (RBA) announced its second interest rate cut of the year, trimming the official cash rate by 0.25%.

This latest cut brings the cash rate down to 3.85%, the lowest level since early 2023. Coming just weeks after the 2025 federal election, the move is expected to stimulate borrowing, lift buyer confidence, and put upward pressure on home prices.

Mortgage Relief Ahead

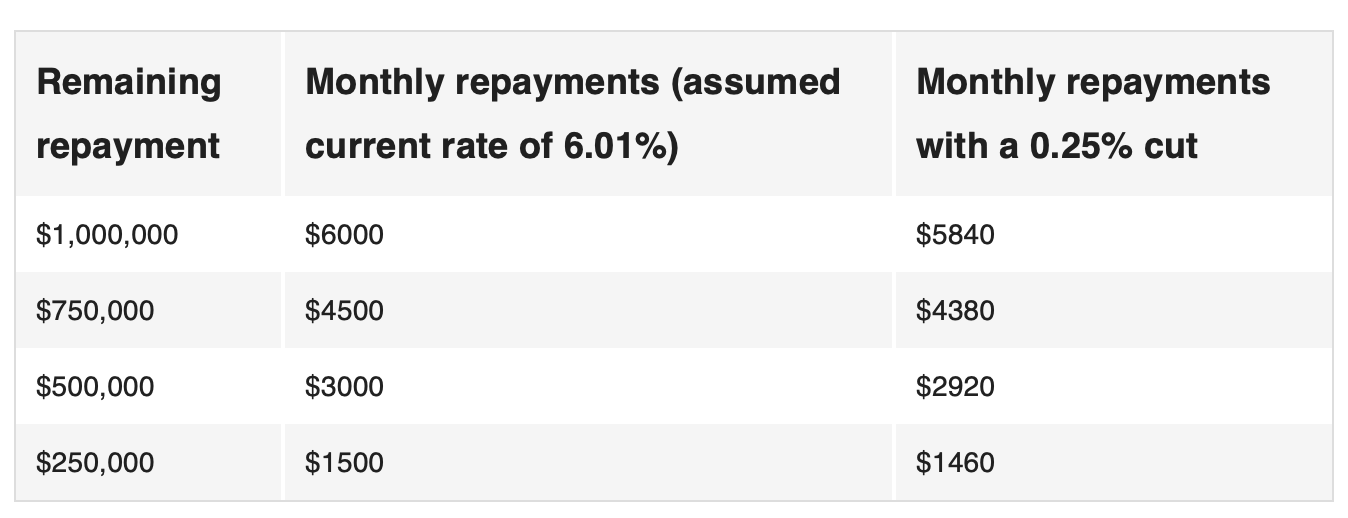

For homeowners, this rate cut signals significant savings. Mortgage Choice estimates that borrowers could save over $100 a week—provided banks and lenders pass on the full rate reduction. The current average interest rate for new mortgages is 6.01%.

REA Group senior economist Eleanor Creagh said the latest decision provides welcome relief for buyers after last month’s pause. However, she cautioned that challenges remain.

“Affordability is still a key concern. Continued improvement will require further rate reductions,” she said. “At the same time, population growth and limited housing supply are continuing to support price growth.”

House Prices Rising—But at a Slower Pace

Home values across Australia hit new record highs in April, although price growth is slowing compared to earlier in the year.

The median national home price is now $805,000.

The average new home loan size for owner-occupiers in Q1 was $659,922.

Adelaide and Melbourne led price growth in April, with median home values at $804,000 and $781,000 respectively.

Sydney, Canberra, and Brisbane remain the most expensive markets, although their growth slowed slightly last month.

Market confidence dipped late last year following 23 months of growth. While inflation is easing, affordability remains a drag. Additionally, U.S. tariff decisions have unsettled some buyers and sellers, though sentiment rebounded following the February rate cut and may do so again.

Creagh anticipates continued—but slower—growth in home prices following the RBA’s decision.

“The pace will likely be more modest compared to recent years,” she noted. “With rising global market volatility and trade tensions, policymakers must remain flexible and cautious.”

Industry Leaders Call for Positive Messaging

Metricon CEO Brad Duggan emphasized the importance of clear and optimistic communication from the RBA to support market confidence.

“We need to hear strong messaging about the economy’s resilience,” Duggan told realestate.com.au. “It’s not just the rate cut—it’s how the cut is presented.”

He noted that February’s rate cut had little effect on land sales or new home contracts due to negative messaging. Duggan pointed to strong fundamentals like core inflation returning to the RBA’s target band and historically low unemployment.

“This cut boosts financial confidence, but people also need to feel secure about the construction journey,” he said.

Duggan expects up to three more rate cuts in 2025, suggesting that a gradual rollout combined with positive sentiment could lead to a significant uptick in new home construction.

More Cuts on the Horizon?

The RBA’s second cut this year marks a delayed but welcome start to what many are calling the “year of cuts.”

Commonwealth Bank forecasts two more cuts in August and November, potentially reducing the cash rate to 3.35% by year-end.

ANZ and Westpac also expect two additional cuts in 2025.

NAB, the only major bank to predict a double cut this month, maintains an aggressive forecast with further reductions in July, August, November, and February 2026.

The RBA’s next cash rate decision is scheduled for 8 July, marking the start of a new financial year and potentially the next chapter in Australia’s rate-cutting cycle.